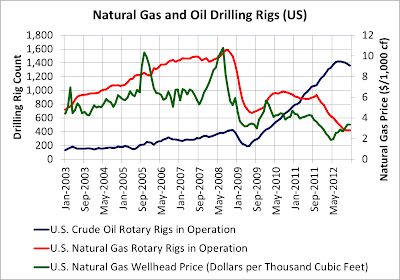

Rig counts for natural gas are at the lowest level in the past 10 years, while oil rigs are at a 10 year high. There are some that may consider the boom in natural gas fracking to be a bubble, but the bubble has already burst as seen in the chart below, with natural gas rigs dropping 73% in the past four years. Oil rigs, on the other hand, are rocketing in the opposite direction, with rig counts rising 225% in the past four years.

The rate of capital formation for investing in natural gas fracking is correlated with the expected returns, driven by natural gas prices. Natural gas prices hit peaks of around $10 per thousand feet both in late 2005 and mid-2008. Over that period of time, up until the great recession, natural gas rig counts continued to climb, reflecting strong investor sentiment on the expected returns available from natural gas fracking.

With the recession taking hold in late 2008, natural gas prices plummeted, dropping 71% over a a 9 month period. As the recession played out, natural gas prices recovered, a little bit, but the result on rig counts, i.e., capital investments in drilling, also dropped precipitously over the same period of time.

A second precipitous drop in natural gas prices also took place in the period from January, 2009 to April, 2012, when natural gas prices dropped 67% from $5.69 to $1.89 per thousand cubic feet. This further has put a restraint on the investors' appetites for investing in natural gas drilling with the rig count currently at 423 rigs. It can also be seen that natural gas prices have recovered somewhat over the past 12 months, increasing approximately 65% off their lows. It is expected that expanding investments in natural gas drilling will require natural gas prices of $5 or more, which is expected to be seen in the next year or two.

Oil rig counts have seen a phenomenal increase in the past four years. This is expected to remain at a high level for several years, as oil prices remain stubbornly high, and provide sufficient incentive for investors to continue pouring capital into drilling activities. Already, domestic crude oil production exceeds crude oil imports, and, when combined with reductions in domestic oil demand, may at some point return the United States to a net oil exporter.

Sunday, March 31, 2013

Friday, March 29, 2013

Electric Car Sharing Service Comes to Paris, Lyon and Villeurbanne - Aggressive Expansion Planned

Back in 2010, the Mayor of Paris, Vincent Charbonnier issued an rfp for an electric car sharing service in Paris. The plan is to put in 3,000 electric vehicles and 1,120 charging stations. The contract was won by a French industrialist, Vincent Bolloré, apparently due to his offering the lowest rental charges for the users of the car sharing service.

What is unique about the Autolib, which the service is called, is that it is the first large scale electric only car sharing service, and that Mr. Bolloré is deploying his company’s innovative battery technology, called a lithium-metal polymer (LMP) battery. This type of battery is considered safer that Lithium-ion batteries, because they do not overheat when charging and discharging. The challenge with these batteries, however, is that they do require to be heated in order to function optimally, which requires additional electricity. Apparently Mr. Bolloré’s company has spent close to $2 billion on battery development since 1996.

What is also unique about Mr. Bolloré’s plans is the electric car itself, the Bluecar, which, in addition to the car sharing service, is being offered for sale for $15,695. He is following Shai Agassi’s model of leasing the battery pack, and here’s the deal: the lease is $105 per month, with unlimited mileage. The car’s characteristics are as follows:

- Four seats

- 155 mile range

- Speed of 75 mph

Thursday, March 28, 2013

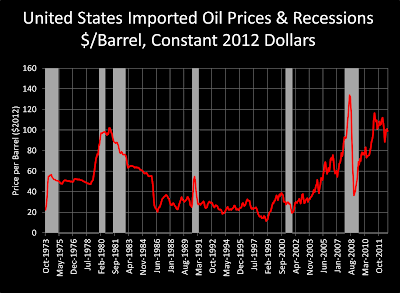

Oil Price Spikes Cause Recessions

Each recession in the last forty years in the United States was presaged by a sharp run-up in oil prices, seen in the chart below. Sustained high oil prices also hold the economy back, which we are experiencing now as in the early 1980s.

High energy prices have effects that ripple through our economy, extracting cash from household incomes and corporate profits. In years past, the United States much more significant market power in oil markets compared to today. When oil prices shot up in the late seventies, the United States reduced demand by switching to more efficient automobiles (Toyotas and Hondas significantly increased market share during this time - that's another issue), shut down oil fired power plants, and improved home and business energy efficiency.

As a result, oil consumption in the United States fell by 16.8% between 1978 and 1983. This drop in United States demand had an impact in tempering global demand for oil, reducing the prices that oil companies and exporting countries could charge. It also helped that OPEC countries were all competing to sell more oil, and that European countries also reduced their oil consumption in similar proportion to the United States. This led to a world awash in oil, leading to lower energy prices, giving the economy a boost to recover in President Reagan's second term.

Currently, the United States is consuming approximately 10.2% less oil in 2012 compared to the country's peak oil consumption in 2005, according to data from the United States Energy Information Agency. Unfortunately, the high prices that the world has been experiencing for several years, appear to be new oil price plateaus. Global demand is very high for oil, with supplies tight. The United States is going to have a very difficult time influencing the supply and demand balance going forward. This circumstance is unfortunate for our economy, as we are continuing to experience the slowest economic recovery since the great depression.

In addition to high oil prices, there are other economic factors tat are holding our economy back. One is the de-leveraging of household and commercial debt. Second is a housing market retrenchment that we are just now coming out of. For more on the hosing market turnaround, see my earlier post here. Third is a business climate that is not seeing a lot of demand, and is favoring cash over capacity additions and hiring.

In the United States, people are making economic decisions in response to high oil prices. As explained in an earlier post on transportation, the United States hit peak oil consumption in 2005, and we are now consuming oil at a level that is approximately 10.2% below our historic peak. This has been accomplished principally by driving fewer miles, and driving more efficient vehicles.

Without oil and natural gas fracking, we would be in a recession, referred to as a double dip. Although natural gas prices have increased 65% in the past year, as seen in my natural gas post here, there still remain near historic lows. Without the significant cost reduction in natural gas, I believe very strongly that we would very likely be back in a recessionary economy.

Going forward, the stars are aligning to keep the economy moving forward, perhaps even at an accelerating pace. These include continued relatively strong job growth in the past 6 months, a surge in new housing starts and a strengthening market for existing homes, extremely favorable natural gas prices, a stock market that continues to perform at market peaks, continued low interest rates and further injections of capital into the market by the United States Federal Reserve.

All is not blue sky and sunny, as fundamental factors impeding long term economic growth will continue to exert significant headwinds on our economy going forward.

High energy prices have effects that ripple through our economy, extracting cash from household incomes and corporate profits. In years past, the United States much more significant market power in oil markets compared to today. When oil prices shot up in the late seventies, the United States reduced demand by switching to more efficient automobiles (Toyotas and Hondas significantly increased market share during this time - that's another issue), shut down oil fired power plants, and improved home and business energy efficiency.

As a result, oil consumption in the United States fell by 16.8% between 1978 and 1983. This drop in United States demand had an impact in tempering global demand for oil, reducing the prices that oil companies and exporting countries could charge. It also helped that OPEC countries were all competing to sell more oil, and that European countries also reduced their oil consumption in similar proportion to the United States. This led to a world awash in oil, leading to lower energy prices, giving the economy a boost to recover in President Reagan's second term.

Currently, the United States is consuming approximately 10.2% less oil in 2012 compared to the country's peak oil consumption in 2005, according to data from the United States Energy Information Agency. Unfortunately, the high prices that the world has been experiencing for several years, appear to be new oil price plateaus. Global demand is very high for oil, with supplies tight. The United States is going to have a very difficult time influencing the supply and demand balance going forward. This circumstance is unfortunate for our economy, as we are continuing to experience the slowest economic recovery since the great depression.

In addition to high oil prices, there are other economic factors tat are holding our economy back. One is the de-leveraging of household and commercial debt. Second is a housing market retrenchment that we are just now coming out of. For more on the hosing market turnaround, see my earlier post here. Third is a business climate that is not seeing a lot of demand, and is favoring cash over capacity additions and hiring.

In the United States, people are making economic decisions in response to high oil prices. As explained in an earlier post on transportation, the United States hit peak oil consumption in 2005, and we are now consuming oil at a level that is approximately 10.2% below our historic peak. This has been accomplished principally by driving fewer miles, and driving more efficient vehicles.

Without oil and natural gas fracking, we would be in a recession, referred to as a double dip. Although natural gas prices have increased 65% in the past year, as seen in my natural gas post here, there still remain near historic lows. Without the significant cost reduction in natural gas, I believe very strongly that we would very likely be back in a recessionary economy.

Going forward, the stars are aligning to keep the economy moving forward, perhaps even at an accelerating pace. These include continued relatively strong job growth in the past 6 months, a surge in new housing starts and a strengthening market for existing homes, extremely favorable natural gas prices, a stock market that continues to perform at market peaks, continued low interest rates and further injections of capital into the market by the United States Federal Reserve.

All is not blue sky and sunny, as fundamental factors impeding long term economic growth will continue to exert significant headwinds on our economy going forward.

Labels:

#carbon,

Brad Bradshaw,

economy,

fracking,

natural gas,

oil,

oil prices,

peak consumption,

recessions

Monday, March 25, 2013

Metal-Air Batteries May Replace Lithium-Ion as the New 'It' Battery Technology - Although Significant Challenges Remain

New technical innovations in metal air batteries may place this technology in a position to replace lithium-ion batteries as the new 'It' battery for grid storage and electric vehicles. Several companies are announcing new breakthroughs that address the long term issues associated with metal air batteries. Metal air batteries work by oxidizing the metal surfaces, using oxygen. Common metals used in metal air batteries include aluminum, zinc, lithium and iron. Commercially available batteries include zinc-air batteries, which are used in hearing aids and pagers. Due to the difficulties in recharging, currently available zinc-air batteries are single use batteries.

One company, Phinergy, is developing an aluminum air battery to provide electric cars with 1,000 mile range. Here is a company video that explains the technology:

One of the companies that is advancing the technology is Fluidic Energy, based in Scottsdale, Arizona. Fluidic is targeting the backup power market for telecommunications, which currently is dominated by diesel generators and lead acid batteries. Fluidic is also partially funded by the United States Department of Energy, raising $5.13 million in 2009, and ARPA-e, raising close to $3 million. More recently, it was announced in March, 2013, that Fluidic secured a Series B round of funding, although no mention of the amount raised can be found. This is in addition to a company regulatory filing in January, 2011 that stated a capital raise of $17.3 million.

The advantage of metal-air batteries is the significant amount of energy stored, with upwards of three-to-four times as much energy stored as compared to lithium-ion batteries. This offers great promise, although the key challenge has been the difficulty in the ability to recharge the batteries. In addition, it is also rarely mentioned that metal air batteries also have low round trip efficiency, perhaps as low as fifty percent (50%).

Some of the companies that are active in developing metal air batteries include:

One company, Phinergy, is developing an aluminum air battery to provide electric cars with 1,000 mile range. Here is a company video that explains the technology:

One of the companies that is advancing the technology is Fluidic Energy, based in Scottsdale, Arizona. Fluidic is targeting the backup power market for telecommunications, which currently is dominated by diesel generators and lead acid batteries. Fluidic is also partially funded by the United States Department of Energy, raising $5.13 million in 2009, and ARPA-e, raising close to $3 million. More recently, it was announced in March, 2013, that Fluidic secured a Series B round of funding, although no mention of the amount raised can be found. This is in addition to a company regulatory filing in January, 2011 that stated a capital raise of $17.3 million.

The advantage of metal-air batteries is the significant amount of energy stored, with upwards of three-to-four times as much energy stored as compared to lithium-ion batteries. This offers great promise, although the key challenge has been the difficulty in the ability to recharge the batteries. In addition, it is also rarely mentioned that metal air batteries also have low round trip efficiency, perhaps as low as fifty percent (50%).

Some of the companies that are active in developing metal air batteries include:

Saturday, March 23, 2013

Critical Role of Natural Gas in Meeting Electricity Demand with Intermittent Wind and Solar Resources

Natural gas is playing an increasingly critical role in keeping grids stabilized around the world with increasing penetration of intermittent wind and solar powered generation sources. Even with the advantageous cycling available with natural gas power plants, however, many grid operators are implementing additional grid stabilization strategies including Power Curtailments, Negative Energy Pricing and Electricity Trading, in addition to available hydro pumped storage and run of river strategies.

In 2012, wind powered generation met thirty-five percent (35%) of the generation resources called upon in Denmark, and contributed a maximum forty-five percent (45%) in September. From a capacity perspective, Denmark's wind turbines hit a capacity level greater than the country's peak requirement, 3.8 GW wind production versus 3.5 GW demand on March 11, 2013. In order to meet the variable production dynamic associated with wind power, the Danish grid operators implemented a series of tactics, including wide swings in electricity trading, both imports and exports, as well as calling upon dynamic dispatching of natural gas generation resources. The Denmark grid has six interconnection points with European grids, facilitating their trade in electricity, supporting both system stability objectives and economic objectives.

In Germany, several notable data points have been achieved with solar power and wind power. On May 25, 2012, Germany hit a peak in solar generation capacity of 22.15 GW, producing 189.24 GWh on that day, contributing fourteen percent (14%) of the country's total electricity requirement. Germany added 1,008 new turbines in 2012, connecting an additional 2,439 MW in new wind capacity to the grid.

From a recent report by the Fraunhofer Institute, solar power plants produced 27.9 TWh in 2012, reaching a 5% share of the gross electricity production of 560 TWh. Wind turbines produced a total of 45.9 TWh in 2012, reaching an 8.2% share of the country's gross electricity production. Accordingly, solar and wind production together 73.8 TWh, representing 13% of the country's total electricity production.

Also from the Fraunhofer report referenced above, the chart below provides details on Germany's electricity production for December, 2012. One can observe in the chart the excessive variability in renewable energy resources, and the compensating for renewable intermittency by ramping both natural gas and hard coal generation resources, while essentially base-loading nuclear and soft coal resources.

It can be observed that natural gas is lower in the merit order loading for economic dispatch relative to coal and nuclear resources, and is called upon extensively to dynamically balance supply and demand.

In 2012, wind powered generation met thirty-five percent (35%) of the generation resources called upon in Denmark, and contributed a maximum forty-five percent (45%) in September. From a capacity perspective, Denmark's wind turbines hit a capacity level greater than the country's peak requirement, 3.8 GW wind production versus 3.5 GW demand on March 11, 2013. In order to meet the variable production dynamic associated with wind power, the Danish grid operators implemented a series of tactics, including wide swings in electricity trading, both imports and exports, as well as calling upon dynamic dispatching of natural gas generation resources. The Denmark grid has six interconnection points with European grids, facilitating their trade in electricity, supporting both system stability objectives and economic objectives.

In Germany, several notable data points have been achieved with solar power and wind power. On May 25, 2012, Germany hit a peak in solar generation capacity of 22.15 GW, producing 189.24 GWh on that day, contributing fourteen percent (14%) of the country's total electricity requirement. Germany added 1,008 new turbines in 2012, connecting an additional 2,439 MW in new wind capacity to the grid.

From a recent report by the Fraunhofer Institute, solar power plants produced 27.9 TWh in 2012, reaching a 5% share of the gross electricity production of 560 TWh. Wind turbines produced a total of 45.9 TWh in 2012, reaching an 8.2% share of the country's gross electricity production. Accordingly, solar and wind production together 73.8 TWh, representing 13% of the country's total electricity production.

Also from the Fraunhofer report referenced above, the chart below provides details on Germany's electricity production for December, 2012. One can observe in the chart the excessive variability in renewable energy resources, and the compensating for renewable intermittency by ramping both natural gas and hard coal generation resources, while essentially base-loading nuclear and soft coal resources.

It can be observed that natural gas is lower in the merit order loading for economic dispatch relative to coal and nuclear resources, and is called upon extensively to dynamically balance supply and demand.

Thursday, March 21, 2013

Hearing March 22 on Massachusetts' Solar Program: Regulatory Changes to 225 CMR 14.00 RPS Class I

On Friday, March 22, 2013, the Commonwealth is holding two important hearings regarding the State's solar programs:

Notice is hereby given that the Massachusetts Department of Energy Resources (“DOER”), acting under statutory authority of Section 11F of Chapter 25A of the General Laws, and in conformance with Chapter 30A of the General Laws, is holding a public hearing on proposed amendments to portions of 225 CMR 14--Renewable Energy Portfolio Standard – Class I (“RPS Class I”). The RPS Class I regulations require all retail electricity suppliers selling electricity to end-use customers in the Commonwealth to obtain a specific minimum percentage of their electricity supply from renewable energy generation sources. The proposed amendments: (1) make strategic revisions to the Solar Carve-Out portion of the RPS Class I program to improve program design and address market concerns; and (2) make several other (non-solar) revisions to

likewise improve the RPS Class I program.

A public hearing will be conducted to receive verbal and written comments on the proposed regulations.

Location: Gardner Auditorium, Massachusetts State House, Boston, MA 02133

Date: March 22, 2013 from 1:00 to 3:00 PM

Verbal and written testimony will be accepted at the hearing; however, parties are requested to provide written copies of their testimony. Written comments will be accepted beginning on March 1, 2013 and ending at 5 pm on March 25, 2013. Please submit written comments to Michael Judge, via mail to the Department of Energy Resources, 100 Cambridge Street, Suite 1020, Boston, MA 02114, or electronically to DOER.SREC@state.ma.us. Copies of the proposed regulations may be obtained from the DOER website www.mass.gov/doer or by contacting Michael Judge at michael.judge@state.ma.us.

BY ORDER OF:

Mark Sylvia, Commissioner

Department of Energy Resources.

- Post-400 MW Solar Policy Development - In the morning, from 10:00 AM to 12:00 Noon, the State is holding hearings on the post-400 MW solar policy development. A presentation relevant to this hearing is available here. Information about the Hearing is available here.

- Regulatory Changes to 225 CMR 14.00 RPS Class I - In the afternoon of March 22, from 1:00 PM to 3:00 PM, the State is convening hearings regarding the proposed changes to the laws regarding the solar carve out program. Information about the Hearings and the Proposed Changes are available here.

NOTICE OF PUBLIC COMMENT AND HEARING

likewise improve the RPS Class I program.

A public hearing will be conducted to receive verbal and written comments on the proposed regulations.

Location: Gardner Auditorium, Massachusetts State House, Boston, MA 02133

Date: March 22, 2013 from 1:00 to 3:00 PM

Verbal and written testimony will be accepted at the hearing; however, parties are requested to provide written copies of their testimony. Written comments will be accepted beginning on March 1, 2013 and ending at 5 pm on March 25, 2013. Please submit written comments to Michael Judge, via mail to the Department of Energy Resources, 100 Cambridge Street, Suite 1020, Boston, MA 02114, or electronically to DOER.SREC@state.ma.us. Copies of the proposed regulations may be obtained from the DOER website www.mass.gov/doer or by contacting Michael Judge at michael.judge@state.ma.us.

BY ORDER OF:

Mark Sylvia, Commissioner

Department of Energy Resources.

Waxman/Whitehouse Carbon Tax Draft

Bicameral Committee introduced draft legislation for a carbon tax. Below are links to the four key documents and the text of the summary one pager of the draft legislation.

Representative Henry A. Waxman, Senator Sheldon Whitehouse, Representative Earl Blumenauer, and Senator Brian Schatz released draft carbon-pricing legislation and solicited feedback on it from stakeholders and the public. The legislation would establish the polluter pays principle for dangerous carbon pollution, requiring large emitters to pay for the pollution they emit.

The “discussion draft” contains a new and straightforward approach to putting a price on carbon pollution. The nation’s largest polluters would have to pay a fee for each ton of pollution they release. The legislation assigns responsibility for the assessment and collection of the carbon fees based upon the expertise that has already been developed by EPA and the Treasury Department. Under the discussion draft, EPA’s database of reported emissions would determine the amount of pollution subject to the fee. The Treasury Department would be responsible for the collection and handling of the fees.

The legislators are specifically requesting feedback on the following questions:

Comments can be submitted by email to cutcarbon@mail.house.gov, with responses being accepted up to April 12, 2013.

Below please find the text of the one-pager summary:

Representative Henry A. Waxman, Senator Sheldon Whitehouse, Representative Earl Blumenauer, and Senator Brian Schatz released draft carbon-pricing legislation and solicited feedback on it from stakeholders and the public. The legislation would establish the polluter pays principle for dangerous carbon pollution, requiring large emitters to pay for the pollution they emit.

The “discussion draft” contains a new and straightforward approach to putting a price on carbon pollution. The nation’s largest polluters would have to pay a fee for each ton of pollution they release. The legislation assigns responsibility for the assessment and collection of the carbon fees based upon the expertise that has already been developed by EPA and the Treasury Department. Under the discussion draft, EPA’s database of reported emissions would determine the amount of pollution subject to the fee. The Treasury Department would be responsible for the collection and handling of the fees.

The legislators are specifically requesting feedback on the following questions:

- What is the appropriate price per ton for polluters to pay? The draft contains alternative prices of $15, $25, and $35 per ton for discussion purposes.

- How much should the price per ton increase on an annual basis? The draft contains a range of increases from 2% to 8% per year for discussion purposes.

- What are the best ways to return the revenue to the American people? The discussion draft proposes putting the revenue toward the following goals, and solicits comments on how to best accomplish each: (1) mitigating energy costs for consumers, especially low-income consumers; (2) reducing the Federal deficit; (3) protecting jobs of workers at trade-vulnerable, energy intensive industries; (4) reducing the tax liability for individuals and businesses; and (5) investing in other activities to reduce carbon pollution and its effects.

- How should the carbon fee program interact with state programs that address carbon pollution?

Comments can be submitted by email to cutcarbon@mail.house.gov, with responses being accepted up to April 12, 2013.

- One Pager: "Tackling Climate Change and Raising Revenue for the American People, Carbon Pollution Fee Discussion Draft" (March 12, 2013).

- Section-by-Section: "Discussion Draft: Fee for Emissions of Carbon Pollution" (March 12, 2013).

- Backgrounder: "Carbon Pollution Fees: A New Workable Approach" (March 12, 2013).

- Bill Text: Discussion Draft of Carbon Pollution Fee (March 12, 2013).

Below please find the text of the one-pager summary:

Tackling Climate Change and Raising Revenue for the

American People

Carbon Pollution Fee Discussion Draft

Carbon

pollution from human activity is driving climate change, which is harming our

economy, health, and environment. The United States is the second-largest

source of annual carbon pollution and has contributed over one-quarter of the

cumulative global carbon pollution from human activity. Scientists warn that we

must act now to reduce carbon pollution to avoid potentially catastrophic

consequences.

The

carbon pollution fee program outlined in this discussion draft released by

Congressman Waxman (D-CA), Senator Whitehouse (D-RI), Congressman Blumenauer

(D-OR), and Senator Schatz (D-HI) will generate substantial revenue while

reducing carbon pollution. The draft abides by the following principles:

•

Polluting

industries should be responsible for the harm they are causing to the American

people.

•

All revenue

generated by the carbon pollution fee should be returned to the American

people.

•

Trade-vulnerable,

energy-intensive industries should be protected.

Specifically,

the discussion draft outlines a legislative framework that would:

•

Establish a

carbon pollution fee that applies to all six categories of greenhouse gases.

•

Require large

carbon pollution sources to pay the fee for carbon pollution permits based on

the quantities of carbon pollution reported by the sources under the EPA’s

Greenhouse Gas Reporting Rule.

•

Create a program

to be jointly administered by the Department of the Treasury and EPA. EPA would

implement and enforce emissions reporting under EPA’s Greenhouse Gas Reporting

Rule, and Treasury would assess, collect, and enforce the fee requirements at

the point where carbon pollution is emitted or passed on to consumers,

depending on the type of source.

This

approach would:

•

Drive significant

carbon pollution reductions.

•

Generate

substantial revenue to be returned to the American people.

•

Provide broad

coverage of greenhouse gas emissions, while minimizing compliance and

administrative burdens and utilizing each agency’s area of expertise.

Comments

on any aspect of the discussion draft are welcome, and the lawmakers have

identified the following key questions for feedback:

1.

What is the

appropriate price per ton for polluters to pay? The draft contains alternative

prices of $15, $25, and $35 per ton for discussion purposes.

2.

How much should

the price per ton increase on an annual basis? The draft contains a range of

increases from 2% to 8% per year for discussion purposes.

3.

What are the best

ways to return the revenue to the American people? The discussion draft proposes

putting the revenue toward the following goals, and solicits comments on how to

best accomplish each: (1) mitigating energy costs for consumers, especially

low-income consumers; (2) reduce the federal deficit; (3) protect the jobs of

workers at trade-vulnerable, energy intensive industries; (4) reduce the tax

liability for individuals and businesses; and (5) invest in other activities to

reduce carbon pollution and its impacts.

4.

How should the

carbon fee program interact with state programs that address carbon pollution?

Wednesday, March 20, 2013

United States Housing Market Turns the Corner - Is Poised for Significant Growth in 2013

All factors point to a very robust 2013 for the United States housing industry:

Sources:

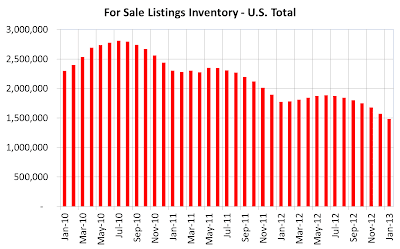

- As observed in the chart below, January housing for sale listings are 47% below their recent peak in July, 2010, and are at their lowest level since 1999;

- Job growth has averaged 205,000 over the past four months, adding 820,000 jobs to the economy, which underpins the housing market;

- Home construction has been extremely low for the past four years, limiting the available stock and supply of housing units;

- House values and the stock market have rebounded, essentially erasing household debts acquired during the recession; and

- Share of household income being used to pay off debt is at 10,6%, which is the lowest proportion of income in the past 29 years.

The coincidence of these factors bodes extremely well for growth in the housing industry. One estimate expects new housing units to increase 40.8% from 2012 to 2013, increasing from 781,000 units to 1,100,000 units. House prices have experienced their biggest year-over-year jump since May, 2006, according to the CoreLogic home price index, which increased 8.3 percent comparing December 2012 to December 2011. The housing industry has turned the corner, and is expected to contribute 0.7% to the growth in the economy this year.

Sources:

- USA Today

- National Association of Realtors

Tuesday, March 19, 2013

United States Housing Starts Near Five Year High

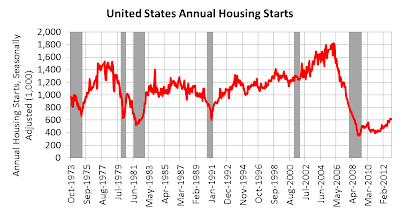

United States single family housing starts roared ahead in February to four and one-half year high. All indications are favorable for a solid recovery in the housing sector, including upward pressures on construction employment and sales of building materials. In summary:

It is also instructive to observe that precipitous falls in housing starts preceded four of the last five recessions. We can also observe fairly steep housing start run-ups, representing overbuilding that gets out ahead of sustainable market levels.

Finally, one of the concerns noted by home builders, relative to their ability to meet increased demand, is their concern over having access to sufficient labor, land and materials. Accordingly, it is likely we will see continued increases in construction employment over the next few years, which will be an important contribution to reducing unemployment.

Sources:

- February single family housing starts, at 618,000 units on an annualized basis, are at a 4 1/2 year high;

- Building permits in February increased 4.6% to 946,000, which is the most since June, 2008, and bodes well for future higher levels of construction activity;

- February 2013 housing starts represented a 31% growth over February 2012 housing starts;

- Existing home prices in January, 2013, were 10% higher than January 2012, due to a strengthening economy;

- There is a 13 year low in houses on the market for sale, further putting upward pressure on housing prices; and

- The outlook for sales over the next six months rose to its highest level in in more than six months.

Finally, one of the concerns noted by home builders, relative to their ability to meet increased demand, is their concern over having access to sufficient labor, land and materials. Accordingly, it is likely we will see continued increases in construction employment over the next few years, which will be an important contribution to reducing unemployment.

Sources:

- United States Census Bureau, U.S. Department of Commerce

- Associated Press

Monday, March 18, 2013

United States Solar Market Grows by Leaps and Bounds

The United States solar market galloped ahead in 2012, growing 75% year-over-year, increasing by 1,424 MW over 2011. The greatest growth occurred in utility scale projects, increasing by 1,021 GW, representing a 124% annual growth.

The cost of designing, procuring and installing solar PV systems continues its steep decline, with the blended average system price dropping a phenomenal 52% in the past three years. These continued precipitous drop in solar costs is a boon to the medium to long term economic viability of solar. In certain markets and applications around the world, solar PV is becoming competitive with grid power. The most competitive applications are grid scale PV installations where installation costs are approaching $2 per watt all in. Certain markets around the world also represent attractive markets due to high extant electricity costs from the grid coupled with high solar insolation.

There is some talk in the industry that solar panels in China are heading to 45 cents per watt. It is also understood that there may be some panel price firming taking place in India, and, at current panel prices, certain solar companies around the world, especially in China where there is a significant over-build in manufacturing capacity, some companies may fail or take on local subsidies to survive.

Deutsche Bank recently released an analysis of global PV markets from the perspective of locations where grid parity will be reached within the next few years. Grid parity may alread have been reached in India, Southern Italy and Spain, where solar developers are proposing projects without requiring subsidies.

When solar crosses the grid parity threshold, solar becomes ever more competitive with existing sources of power generation. One of the surprising market dynamics that is being seen in Germany and Texas, is the basis for economic dispatch of power plants being determined by marginal cost to produce the next electron. Because solar and wind have no fuel costs, this means that are beginning to crowd out fuel-based generating supply.

Once the grid parity threshold is crossed, the adoption of renewables will accelerate, constrained only by capital formation and grid interconnections.

There is another dynamic associated with the economics of wide spread adoptions of solar PV on the grid - long term economics. Germany has made significant use of feed in tariffs to financially support PV systems. In the short term, these feed in tariffs exert a large financial burden on the electric utility companies and their ratepayers. Once, however, the FIT payment schedules reach the end of their payment schedule, the utiltiies will no longer have to subsidize the solar systems, with the result being free power. At that point, depending on the ultimate penetration of zero fuel renewable resources, primarily wind and solar, the utilities will have a cost structure focused on grid capitalization and management, and managing generation and storage resources focused on maintaining grid stability and safe reliable power distribution.

The global market for solar PV has quadrupled in the past three years, increasing from 7,438 MW of installed capacity in 2009, to over 30,000 MW of an estimated installed capacity in 2012, 400% growth. The annual growth of the global PV market appears to have leveled off between 2011 and 2012.

What is also apparent in the global data is the unevenness of year to year deployment in certain countries. The pace of deployment in Germany, for example has leveled off over the past three years. Italy experienced considerable growth in 2011, and has suffered a significant pull back in deployments in 2012, along with France and Spain.

Other countries, such as the United States, China and Japan, are currently seeing significant growth in their solar PV markets.

Sources:

The cost of designing, procuring and installing solar PV systems continues its steep decline, with the blended average system price dropping a phenomenal 52% in the past three years. These continued precipitous drop in solar costs is a boon to the medium to long term economic viability of solar. In certain markets and applications around the world, solar PV is becoming competitive with grid power. The most competitive applications are grid scale PV installations where installation costs are approaching $2 per watt all in. Certain markets around the world also represent attractive markets due to high extant electricity costs from the grid coupled with high solar insolation.

There is some talk in the industry that solar panels in China are heading to 45 cents per watt. It is also understood that there may be some panel price firming taking place in India, and, at current panel prices, certain solar companies around the world, especially in China where there is a significant over-build in manufacturing capacity, some companies may fail or take on local subsidies to survive.

Deutsche Bank recently released an analysis of global PV markets from the perspective of locations where grid parity will be reached within the next few years. Grid parity may alread have been reached in India, Southern Italy and Spain, where solar developers are proposing projects without requiring subsidies.

When solar crosses the grid parity threshold, solar becomes ever more competitive with existing sources of power generation. One of the surprising market dynamics that is being seen in Germany and Texas, is the basis for economic dispatch of power plants being determined by marginal cost to produce the next electron. Because solar and wind have no fuel costs, this means that are beginning to crowd out fuel-based generating supply.

Once the grid parity threshold is crossed, the adoption of renewables will accelerate, constrained only by capital formation and grid interconnections.

There is another dynamic associated with the economics of wide spread adoptions of solar PV on the grid - long term economics. Germany has made significant use of feed in tariffs to financially support PV systems. In the short term, these feed in tariffs exert a large financial burden on the electric utility companies and their ratepayers. Once, however, the FIT payment schedules reach the end of their payment schedule, the utiltiies will no longer have to subsidize the solar systems, with the result being free power. At that point, depending on the ultimate penetration of zero fuel renewable resources, primarily wind and solar, the utilities will have a cost structure focused on grid capitalization and management, and managing generation and storage resources focused on maintaining grid stability and safe reliable power distribution.

The global market for solar PV has quadrupled in the past three years, increasing from 7,438 MW of installed capacity in 2009, to over 30,000 MW of an estimated installed capacity in 2012, 400% growth. The annual growth of the global PV market appears to have leveled off between 2011 and 2012.

What is also apparent in the global data is the unevenness of year to year deployment in certain countries. The pace of deployment in Germany, for example has leveled off over the past three years. Italy experienced considerable growth in 2011, and has suffered a significant pull back in deployments in 2012, along with France and Spain.

Other countries, such as the United States, China and Japan, are currently seeing significant growth in their solar PV markets.

Sources:

Sunday, March 17, 2013

Tectonic Shift in US Transportation Continued in 2012

Transportation in the United States continued its tectonic shift in 2012, with gasoline sales and miles driven continuing to decline, and model year fleet efficiency continuing to climb. Never before, over decades of data, have miles driven not returned to their pre-recession levels by this stage in an economic recovery. These changes generally bode well for the US economy and households, with benefits including:

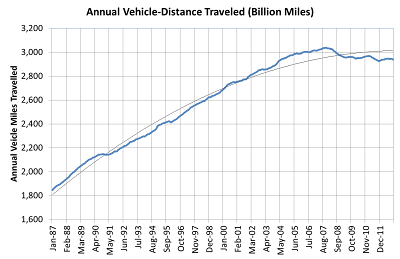

Vehicle miles driven peaked in the United States in 2007, seen in the chart below, at 3,026 billion miles, and, in 2012, was 2,942 billion miles, 2.8% below the 2007 peak.

Model year vehicle efficiency continues to grow, as seen in the chart below, 2012 average miles per gallon of vehicles sold was 23.9 MPG, which is a 14% increase over the vehicles sold in 2008 of 20.9 mpg.

Sources:

- Reduced oil imports;

- Favorable impact on international balance of trade;

- Reduced pressure on the dollar against foreign currencies; and

- Favorable impact on household finances, with fewer dollars spent on gasoline.

The contrary position is that these changes are a result of significant economic pain across our economy, due to high and prolonged oil prices, that have caused prolonged economic dislocation, evidenced by continued high unemployment, restrained consumer spending and economic growth below expectations and below average. These observations are evidenced in the data provided below.

Gasoline sales in 2012, seen in the chart below, are at a level not seen since 1997, and are 8% below the peak set in 2005.

Vehicle miles driven peaked in the United States in 2007, seen in the chart below, at 3,026 billion miles, and, in 2012, was 2,942 billion miles, 2.8% below the 2007 peak.

Model year vehicle efficiency continues to grow, as seen in the chart below, 2012 average miles per gallon of vehicles sold was 23.9 MPG, which is a 14% increase over the vehicles sold in 2008 of 20.9 mpg.

Sources:

- United States Energy Information Agency

- United States Department of Transportation

- United States Environmental Protection Agency

Labels:

balance of trade,

economy,

efficiency,

Energy,

gasoline,

miles driven,

MPG,

national accounts,

transportation

Saturday, March 16, 2013

President Obama Proposes $2 billion Energy Security Trust to Fund Alternative Transportation Fuels

President Obama, (See Video Here) while touring the Argonne National Laboratory outside Chicago on Friday, introduced his plan for an Energy Security Trust to accelerate the development of alternative fuels for transportation. The objective is to reduce the impact on America's families and the economy from high priced and volatile oil. The plan is designed to be revenue neutral, drawing upon $2 billion of oil and gas offshore gas and oil drilling royalties over ten years, to fund technologies including advanced batteries, biofuels, natural gas fuel tanks, hydrogen fuel cells.

"Over 10 years, the Energy Security Trust will provide $2 billion for critical, cutting-edge research focused on developing cost-effective transportation alternatives.The funding will be provided by revenues from federal oil and gas development, and will not add any additional costs to the federal budget. The investments will support research into a range of technologies – things like advanced vehicles that run on electricity, homegrown biofuels, and domestically produced natural gas. It will also help fund a small number of real-world experiments that try different transportation techniques in cities and towns around the country using advanced vehicles at scale."

Friday, March 15, 2013

Natural Gas Prices Increase 65% in 12 Months

Natural gas prices have been increasing over the past twelve months, rising from a low of below $2 per MMBtu in April, 2012 to over $3.50 per MMBtu this week.

The market is adjusting to key price factors, including:

The market is adjusting to key price factors, including:

- Continued expansion and increased utilization of natural gas fired power plants creating high demand;

- Natural gas fracking requires higher natural gas pricing to support capital investments based on expected returns. Capital formation for fracking has gone flat due to low natural gas prices;

- Plans to export natural gas (LNG) to higher cost European markets creates support for a higher price floor.

For more on the natural gas market, please see the following:

- Market Realist article: Rise in Natural Gas Prices on the Week is Short Term Positive for Nat Gas Names

- Bloomberg Video: Jeffries' Eads Sees Natural Gas Rising to $5

Labels:

$/mmbtu,

Bloomberg,

economics,

electricity generation,

Energy,

exports,

fracking,

lng,

natural gas,

prices

Thursday, March 14, 2013

Smart Grid Company Silver Spring Networks' NASDAQ IPO Raises $81 Million - Shares Surge 29% on First Day of Trading

Smart Grid Company Silver Spring Networks raises $81 million in long awaited IPO, with shares surging 29% on the first day of trading. This IPO puts the company's valuation at approximately $750 million, and gives the company access to capital markets, an important source of capital to fund the company's operations going forward. There are a few points to raise regarding this offering:

- The company sold 4.75 million shares, up from the 3.75 million shares it had expected to sell as of last week;

- None of the existing investors sold their shares in the IPO, preferring to hold onto their investments;

- The company has raised approximately $303 million in debt and equity since 2004;

- 2012 revenues of $197 million are 17% lower than 2011 revenues of $237;

- Silver Spring Networks lost close to $90 million in 2012, a number that has to get smaller very fast, or the company runs the risk of approaching subsequent capital raises just to fund negative margin operations;

- The majority of the company's revenues come from 7 major United States utility customers; and

- The boom in smart meter deployments in the United States has subsided.

The basis for the company's valuation and future growth prospects is premised on the following:

- Leverage the Installed Base - Silver Spring Networks' deployed smart grid communications networks are platforms for deploying additional products and services up and down the energy value chain, from DSCADA to improve utility grid performance and operation, to leveraging the customer interface for utilities, and into the customer's premise, providing energy management control and data acquisition for customers. Demand response, for example, represented a very small proportion of hte company's revenues;

- Expand Internationally - The opportunity for smart grid deployments and AMI continues to expand internationally, recognizing that Silver Spring Networks already has customer relationships in Australia, Brazil, the UK and Singapore. International only accounted for an estimated 8% of revenues in 2012.

- Deploy Additional Equipment and Services - Much like Itron, Silver Spring Networks has the opportunity to leverage its stock to acquire additional equipment and software companies to layer additional revenue generating services on top of their smart grid platform.

- Expand Into Additional Markets - Silver Spring Networks also has the opportunity to deploy their communications networks and solutions in gas and water industries, as well as selectively targeting other network and industrial businesses that can use their wide area energy management capabilities, perhaps including trains and natural gas pipelines.

At the end of the day, for this IPO to be successful, the Silver Spring Networks has to have a brilliant execution strategy over the next 12 months in order to demonstrate that they can meet the expectations embodied in this first day of trading. Critical will be (1) turning around the decline in revenues; (2) reducing losses on a quarterly basis to demonstrate being on a pathway to a sustainable cash flow; (3) demonstrating success in expanding into new international markets; and (4) demonstrating their ability to expand products and services to leverage their core network platform.

Labels:

Electric,

Energy,

Gas,

IPO,

Itron,

NASDAQ,

Silver Spring Networks,

Smart Grid,

Utility,

Water

Wednesday, March 13, 2013

Commercial Fleet Hybrid-Electric Powertrain Company, XL Hybrids, Secures $4 Million In Series B Investment

XL Hybrids, a Fleet Hybrid Conversion company, announced today that they secured $4 million in a Series B investment to fund the growth of their hybrid electric powertrain business. XL Hybrids designed an add-on hybrid-electric solution for commercial fleets to improve their fuel efficiency by 20% or more, without making major modifications to existing OEM vehicles in commercial service. Their add-on solution, seen in the image below, captures and stores energy through regenerative braking.

The XL Hybrids system is designed to work on the most popular Class 1-3 fleet vehicles, including cargo/utility/shuttle vans and pickup trucks. The hybrid drive train is installed either as a retrofit to an existing vehicle, or installed as an upfit onto a new vehicle before delivery. The system is installed through a nationwide network of certified installation partners.

The system consists of a 40 kW Peak Power Permanent Magnet Electric Motor coupled with a 2 kWh Lithium-Ion Battery and Control System, delivering 220 lb-ft of peak torque.

From the company:

PRESS RELEASE

XL Hybrids Secures $4 Million In Series B Investment Financing

Will Support Product Growth Throughout North America

BOSTON, March 13, 2013 – XL Hybrids, Inc., provider of a low-cost hybrid electric powertrain designed for class 1 to 3 commercial fleet vehicles, today announced that it has raised $4 million in a series B investment round led by private investors, with previous investors also participating in the round. After developing its hybrid powertrain technology and validating it in the field with multiple Fortune 500 companies, XL Hybrids will use this funding to ramp up the delivery of its hybrid electric powertrain to existing and new customers.

Investors in this round include successful entrepreneurs and leading business executives from multiple industries, including automotive, energy, software and finance. While massive government loans and other sources of funding dry up for many cleantech companies, XL Hybrids has proven its ability to deliver fuel savings with a cost-effective technology, sell to large Fortune 500 companies and implement a capital-efficient business model. XL Hybrids’ hybrid electric powertrain reduces fuel consumption by 20 percent and can be installed in both new and existing vehicles. This type of system is ideal for companies operating commercial vans, box-trucks and shuttles in and around major urban markets.

“This round of investment enables us to start scaling our business and expanding our geographic reach. We are working with customers that have large national and international fleets, and we can now help them save fuel and money at a larger scale,” said Tod Hynes, president and founder of XL Hybrids. “With support from our investors, XL Hybrids will continue to expand the availability of our hybrid powertrain and meet the demands of commercial fleets looking for a proven return on investment and reduced emissions.”

This latest investment round brings the total amount of funding for XL Hybrids to approximately $8 million. Earlier this quarter, XL Hybrids expanded its product line to offer hybrid powertrain technology for Ford E-Series vans; the company can now offer a compelling return on investment and significant emissions reductions to more than 75 percent of light duty van fleet buyers. XL Hybrids also signed an installation partnership and distribution agreement with Leggett & Platt Commercial Vehicle Products (CVP), providing its customers with ship-through ordering.

For more information on XL Hybrids technology and availability, visit www.xlhybrids.comor email info [at] xlhybrids.com.

About XL Hybrids

XL Hybrids designs, manufactures and installs hybrid electric powertrains for commercial vans and trucks. The company’s patent-pending hybrid electric powertrain can be installed on existing vehicles or as an upfit on new ones. By storing energy wasted in braking and reapplying it during acceleration, XL Hybrids technology decreases fuel use and carbon dioxide emissions by up to 21.2 percent on urban routes, while operating with the same durability and reliability as traditional vans and trucks. XL Hybrids was founded by MIT alumni and is based in Boston. For more information, visit www.xlhybrids.com.

The XL Hybrids system is designed to work on the most popular Class 1-3 fleet vehicles, including cargo/utility/shuttle vans and pickup trucks. The hybrid drive train is installed either as a retrofit to an existing vehicle, or installed as an upfit onto a new vehicle before delivery. The system is installed through a nationwide network of certified installation partners.

The system consists of a 40 kW Peak Power Permanent Magnet Electric Motor coupled with a 2 kWh Lithium-Ion Battery and Control System, delivering 220 lb-ft of peak torque.

From the company:

PRESS RELEASE

XL Hybrids Secures $4 Million In Series B Investment Financing

Will Support Product Growth Throughout North America

BOSTON, March 13, 2013 – XL Hybrids, Inc., provider of a low-cost hybrid electric powertrain designed for class 1 to 3 commercial fleet vehicles, today announced that it has raised $4 million in a series B investment round led by private investors, with previous investors also participating in the round. After developing its hybrid powertrain technology and validating it in the field with multiple Fortune 500 companies, XL Hybrids will use this funding to ramp up the delivery of its hybrid electric powertrain to existing and new customers.

Investors in this round include successful entrepreneurs and leading business executives from multiple industries, including automotive, energy, software and finance. While massive government loans and other sources of funding dry up for many cleantech companies, XL Hybrids has proven its ability to deliver fuel savings with a cost-effective technology, sell to large Fortune 500 companies and implement a capital-efficient business model. XL Hybrids’ hybrid electric powertrain reduces fuel consumption by 20 percent and can be installed in both new and existing vehicles. This type of system is ideal for companies operating commercial vans, box-trucks and shuttles in and around major urban markets.

“This round of investment enables us to start scaling our business and expanding our geographic reach. We are working with customers that have large national and international fleets, and we can now help them save fuel and money at a larger scale,” said Tod Hynes, president and founder of XL Hybrids. “With support from our investors, XL Hybrids will continue to expand the availability of our hybrid powertrain and meet the demands of commercial fleets looking for a proven return on investment and reduced emissions.”

This latest investment round brings the total amount of funding for XL Hybrids to approximately $8 million. Earlier this quarter, XL Hybrids expanded its product line to offer hybrid powertrain technology for Ford E-Series vans; the company can now offer a compelling return on investment and significant emissions reductions to more than 75 percent of light duty van fleet buyers. XL Hybrids also signed an installation partnership and distribution agreement with Leggett & Platt Commercial Vehicle Products (CVP), providing its customers with ship-through ordering.

For more information on XL Hybrids technology and availability, visit www.xlhybrids.comor email info [at] xlhybrids.com.

About XL Hybrids

XL Hybrids designs, manufactures and installs hybrid electric powertrains for commercial vans and trucks. The company’s patent-pending hybrid electric powertrain can be installed on existing vehicles or as an upfit on new ones. By storing energy wasted in braking and reapplying it during acceleration, XL Hybrids technology decreases fuel use and carbon dioxide emissions by up to 21.2 percent on urban routes, while operating with the same durability and reliability as traditional vans and trucks. XL Hybrids was founded by MIT alumni and is based in Boston. For more information, visit www.xlhybrids.com.

Subscribe to:

Posts (Atom)