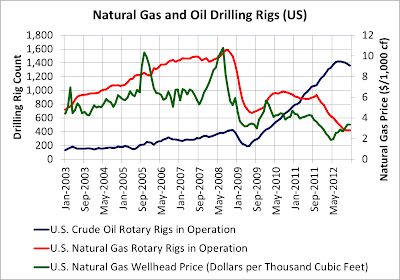

Rig counts for natural gas are at the lowest level in the past 10 years, while oil rigs are at a 10 year high. There are some that may consider the boom in natural gas fracking to be a bubble, but the bubble has already burst as seen in the chart below, with natural gas rigs dropping 73% in the past four years. Oil rigs, on the other hand, are rocketing in the opposite direction, with rig counts rising 225% in the past four years.

The rate of capital formation for investing in natural gas fracking is correlated with the expected returns, driven by natural gas prices. Natural gas prices hit peaks of around $10 per thousand feet both in late 2005 and mid-2008. Over that period of time, up until the great recession, natural gas rig counts continued to climb, reflecting strong investor sentiment on the expected returns available from natural gas fracking.

With the recession taking hold in late 2008, natural gas prices plummeted, dropping 71% over a a 9 month period. As the recession played out, natural gas prices recovered, a little bit, but the result on rig counts, i.e., capital investments in drilling, also dropped precipitously over the same period of time.

A second precipitous drop in natural gas prices also took place in the period from January, 2009 to April, 2012, when natural gas prices dropped 67% from $5.69 to $1.89 per thousand cubic feet. This further has put a restraint on the investors' appetites for investing in natural gas drilling with the rig count currently at 423 rigs. It can also be seen that natural gas prices have recovered somewhat over the past 12 months, increasing approximately 65% off their lows. It is expected that expanding investments in natural gas drilling will require natural gas prices of $5 or more, which is expected to be seen in the next year or two.

Oil rig counts have seen a phenomenal increase in the past four years. This is expected to remain at a high level for several years, as oil prices remain stubbornly high, and provide sufficient incentive for investors to continue pouring capital into drilling activities. Already, domestic crude oil production exceeds crude oil imports, and, when combined with reductions in domestic oil demand, may at some point return the United States to a net oil exporter.

No comments:

Post a Comment