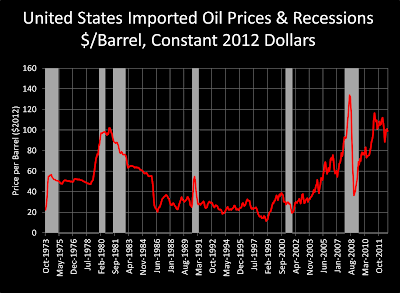

Each recession in the last forty years in the United States was presaged by a sharp run-up in oil prices, seen in the chart below. Sustained high oil prices also hold the economy back, which we are experiencing now as in the early 1980s.

High energy prices have effects that ripple through our economy, extracting cash from household incomes and corporate profits. In years past, the United States much more significant market power in oil markets compared to today. When oil prices shot up in the late seventies, the United States reduced demand by switching to more efficient automobiles (Toyotas and Hondas significantly increased market share during this time - that's another issue), shut down oil fired power plants, and improved home and business energy efficiency.

As a result, oil consumption in the United States fell by 16.8% between 1978 and 1983. This drop in United States demand had an impact in tempering global demand for oil, reducing the prices that oil companies and exporting countries could charge. It also helped that OPEC countries were all competing to sell more oil, and that European countries also reduced their oil consumption in similar proportion to the United States. This led to a world awash in oil, leading to lower energy prices, giving the economy a boost to recover in President Reagan's second term.

Currently, the United States is consuming approximately 10.2% less oil in 2012 compared to the country's peak oil consumption in 2005, according to data from the United States Energy Information Agency. Unfortunately, the high prices that the world has been experiencing for several years, appear to be new oil price plateaus. Global demand is very high for oil, with supplies tight. The United States is going to have a very difficult time influencing the supply and demand balance going forward. This circumstance is unfortunate for our economy, as we are continuing to experience the slowest economic recovery since the great depression.

In addition to high oil prices, there are other economic factors tat are holding our economy back. One is the de-leveraging of household and commercial debt. Second is a housing market retrenchment that we are just now coming out of. For more on the hosing market turnaround, see my earlier post here. Third is a business climate that is not seeing a lot of demand, and is favoring cash over capacity additions and hiring.

In the United States, people are making economic decisions in response to high oil prices. As explained in an earlier post on transportation, the United States hit peak oil consumption in 2005, and we are now consuming oil at a level that is approximately 10.2% below our historic peak. This has been accomplished principally by driving fewer miles, and driving more efficient vehicles.

Without oil and natural gas fracking, we would be in a recession, referred to as a double dip. Although natural gas prices have increased 65% in the past year, as seen in my natural gas post here, there still remain near historic lows. Without the significant cost reduction in natural gas, I believe very strongly that we would very likely be back in a recessionary economy.

Going forward, the stars are aligning to keep the economy moving forward, perhaps even at an accelerating pace. These include continued relatively strong job growth in the past 6 months, a surge in new housing starts and a strengthening market for existing homes, extremely favorable natural gas prices, a stock market that continues to perform at market peaks, continued low interest rates and further injections of capital into the market by the United States Federal Reserve.

All is not blue sky and sunny, as fundamental factors impeding long term economic growth will continue to exert significant headwinds on our economy going forward.

No comments:

Post a Comment