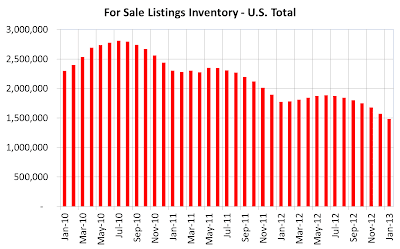

- As observed in the chart below, January housing for sale listings are 47% below their recent peak in July, 2010, and are at their lowest level since 1999;

- Job growth has averaged 205,000 over the past four months, adding 820,000 jobs to the economy, which underpins the housing market;

- Home construction has been extremely low for the past four years, limiting the available stock and supply of housing units;

- House values and the stock market have rebounded, essentially erasing household debts acquired during the recession; and

- Share of household income being used to pay off debt is at 10,6%, which is the lowest proportion of income in the past 29 years.

The coincidence of these factors bodes extremely well for growth in the housing industry. One estimate expects new housing units to increase 40.8% from 2012 to 2013, increasing from 781,000 units to 1,100,000 units. House prices have experienced their biggest year-over-year jump since May, 2006, according to the CoreLogic home price index, which increased 8.3 percent comparing December 2012 to December 2011. The housing industry has turned the corner, and is expected to contribute 0.7% to the growth in the economy this year.

Sources:

- USA Today

- National Association of Realtors

No comments:

Post a Comment